Founded in 2015 by Huw Lougher, Contemporary Lougher established itself as a “space where anyone can buy a work of art, either as an investment or simply because they like it”. Individual motivations for buying art are diverse and multifaceted, and Lougher Contemporary has grown to accommodate collectors at all stages, from those just starting out to those well seasoned. Aiming to demystify and simplify the art collecting process and provide a comprehensive gateway to engage with the market, Lougher Contemporary is a stress-free platform that helps collectors achieve their goals, whether it’s diversifying an investment portfolio or simply acquiring works by artists you love.

Customer peace of mind is at the heart of how the gallery operates, which is why transparency and due diligence are hallmarks of how Lougher Contemporary operates. Offering authenticated works made by the artist or produced directly by the artist’s foundation, collectors can be assured that they are getting top-notch works; and those who ship art through the gallery get an overview of pricing and commission rates every step of the way.

We reached out to Lougher to find out more about what first sparked his interest in the art world, his advice to collectors, and what his observations and predictions are for today’s art market.

Huw Lougher. Courtesy of Lougher Contemporary.

Can you tell us about your background? What first inspired your interest in art and the art market?

I started getting interested in art and the art market in 2007. I was training to become an accountant, with no interest or prior training in the art industry. I remember loving the buzz around Thursday night openings at Elms Lesters and Lazarides Gallery or a new Banksy appearing on the streets of London. My first acquisition was a signed Banksy print from Pictures on Walls. It cost £450 and its acquisition sparked what has since become both a passion and a career. This print hangs on my wall now.

My interest in the art market developed around the same time after seeing an Andy Warhol silkscreen on canvas in a museum in Stockholm. I had no idea what I was looking at, but naturally wondered why it was there and how something like that could be worth so much. Don Thompson’s book The $12 million plush shark (2008) helped me answer this question, and since then I have embarked on an almost obsessive journey to understand the art market.

What led you to found Lougher Contemporary?

I always had the ambition to run my own business. Although I value my corporate experience for what it taught me, I knew it wasn’t for me. I tried several different companies before starting Lougher Contemporary in 2015.

As a collector, I have always enjoyed commissioning and supporting young artists, and my wife and I have acquired many paintings and early works by emerging artists dating back to 2008. Looking for a way to turn my passion for art in a business, I started working with a few artists between 2013 and 2015. I liked it, but as a business model, I found it difficult. I needed to find and build something that I could scale with fewer restrictions.

I had already had great success buying editions that had risen in value, and as such, focusing Lougher Contemporary on the secondary market for established artists’ editions was the obvious choice. This is an area of the market where you can be as active as you want without impacting an artist’s career or upsetting a primary market gallery. I consider this to be an attractive sector of the art market for new and experienced art collectors, and those who like to combine their passion for art with investment.

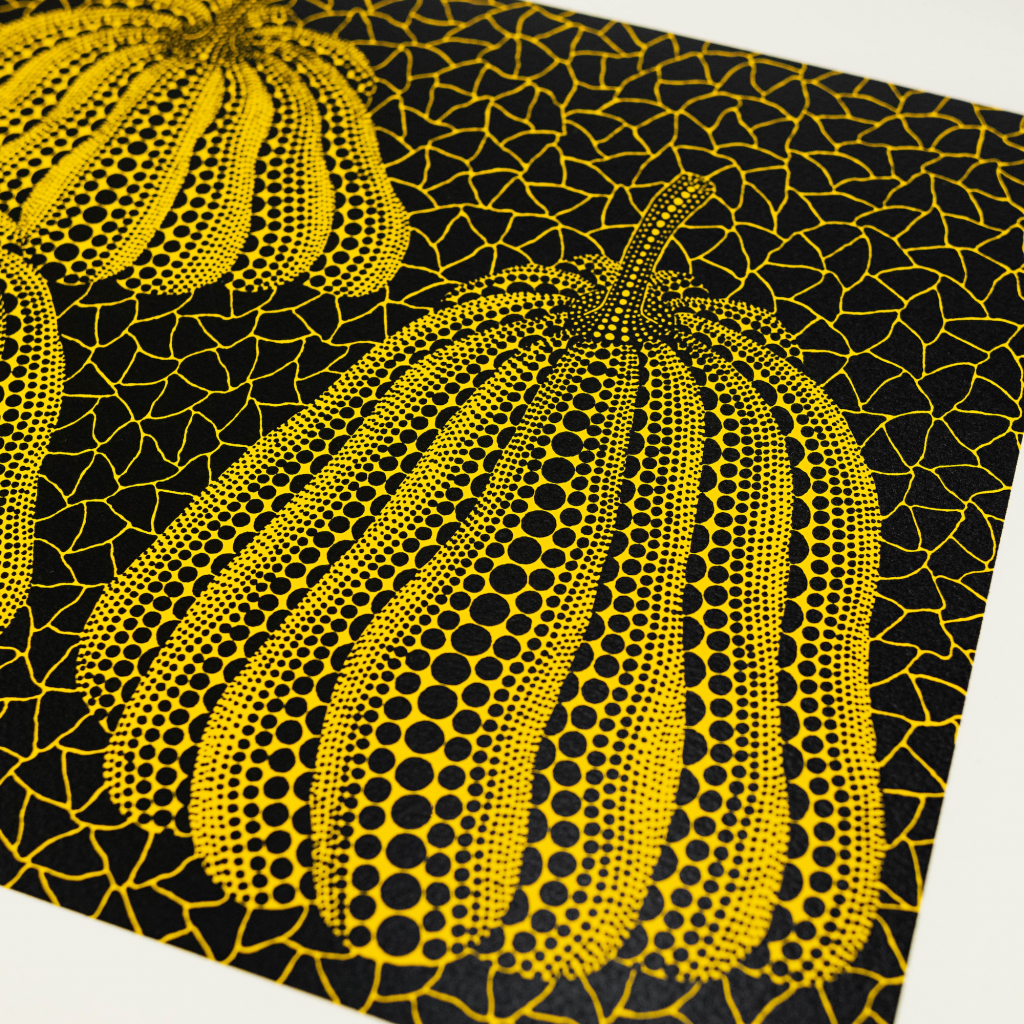

Yayoi Kusama, three pumpkins (1993). Courtesy of Lougher Contemporary.

Why is it?

Art is widely considered high risk and illiquid, and this is true for most sectors of the art market. More often than not, a painting you buy from your local gallery has no secondary market value, meaning you would never have the ability to sell if you needed to. That’s good for a lot of art buyers, but I had no interest in that sector of the market, and wanted Lougher Contemporary to offer something different.

Established artists’ editions inherently offer greater liquidity and lower risk investment potential than the rest of the art market, and that’s what attracted me. It gave me confidence in what I was buying and ultimately what I was presenting and selling to customers.

It’s always been a little taboo to talk about art as an investment. It’s not important to everyone, but I quickly realized that most art collectors, whether they dare to admit it or not, care about the value of their collection and they like to see their art appreciate over time. These are the clients I wanted to work with and, if I’m being honest, the ones I love working with the most. After all, it is difficult for me to advise a client on what he likes or what his partner likes!

What is the basic philosophy of Lougher Contemporary?

We have an incredibly loyal and passionate clientele, with whom we have worked closely for years. We are praised daily for our customer service, and I believe this has been the key factor in our success: we put our customers at the center of everything we do.

The Lougher Contemporary team agrees. They respect our customers and will go out of their way to ensure that all of our customers, whether new or old, are satisfied with the service we provide.

Ultimately, buying art is not just about buying property. It should be an experience and we want to make this experience as smooth and enjoyable as possible. We work with a level of transparency and trust that is rare in the art market. In creating Lougher Contemporary, I promised myself to provide a level of customer service and transparency far above the norm in the market. We’re not in the business solely to make money or maximize profits – my reasons for running Lougher Contemporary go way beyond that.

Bridget Riley, About Lilac (2007). Courtesy of Lougher Contemporary.

What is your vision for Lougher Contemporary, how do you see the development of the art market?

Although now established, I consider this to be just the start of Lougher Contemporary and we have exciting plans for the years to come. As a team, we are very good at identifying where we can improve and this has led us to a mindset of continuous improvement, both in our internal operations and in our customer offering. There is no end point to this, so I am very pleased to see how we are developing as a team and as a company, and this is often recognized by our clientele.

Our vision is to become the go-to place for collectors with a passion for art and the art market, who want to build a collection, discover the market and enjoy the whole experience, from their first acquisition to their first sale on consignment. through us.

We have continuously developed our consignment offering, allowing collectors to buy from us and, more importantly, sell through us when the time is right. After developing this service over the past 18 months, I now believe we have the best proposition on the market for collectors looking to sell. At the end of 2022, we also launched Lougher Advisory, an area of the business that I am very passionate about.

If you could give one piece of advice to a new collector starting out on their journey as a collector, what would it be?

It really depends on what motivates you and your reasons for buying.

If you’re not financially motivated at all, then the “buy what you like” cliché holds true. But if you want to buy art that has a good chance of retaining its value or, better yet, increasing its value, you should either work with an advisor or invest time in understanding the art market. art.

The art market is unlike any other, fascinating and extremely rewarding. It’s also a community, so meet and surround yourself with people who are on the same path. Go to as many art shows and art fairs, look at as many works of art, and talk to as many people as possible.

If your reason for collecting art is also financial and you lack the ability to learn the market, I would recommend finding an art advisor, someone you trust and love to work. Like all consultants, a good art consultant is an investment, not a cost.

If you don’t want to do either, just buy established artists’ editions. You can buy iconic artwork from top-notch artists, and if you ever need to free up the investment for something else, you’ll have the option to sell.

Banksy, Four cans of soup – Gold on cream (2005). Courtesy of Lougher Contemporary.

A lot has changed in the art world over the past few years. Do you have any forecasts for the future of the art market? Are there any trends you’ve noticed that you find particularly exciting?

As a collector, nothing has changed – a lot of artwork is still being made and amazing artists are popping up. I have recently returned from Art Basel and Banksy’s ‘Cut and Run’ exhibition in Glasgow and there is no doubt that the appetite and passion for art has not waned.

For Lougher Contemporary, it’s been a roller coaster since the start of 2020 and the start of the pandemic. It has been busy, arguably too busy with a lot of hype in the market, but over the past year things have calmed down and there is no doubt that we are now in a lull.

Fewer buyers in the market also means better buying opportunities, and I predict that will remain for the foreseeable future. This year we have purchased some very solid works, both for stock and for clients, and we continue to advise collectors, whether they are looking to take advantage of these opportunities, consolidate and ride this wave, or on the contrary to reduce the size of their collection. .

Personally, I appreciate the challenges that this market throws at us. Faced with a more difficult market and increased competition, we must adapt and make the transition. This is going very well and has given us a huge opportunity to develop and expand our offering. I have big ambitions for the company, and I look forward to seeing where the team and I can take Lougher Contemporary in the years to come.

Learn more about Lougher Contemporary here.

Follow Artnet News on Facebook:

Want to stay one step ahead of the art world? Subscribe to our newsletter to receive breaking news, revealing interviews and incisive reviews that move the conversation forward.