The market for third-party guarantees – which offer auction houses and sellers a useful tool to hedge their bets – shows no signs of slowing down, reaching a likely all-time high of $3.4 billion in 2022. But a market darker and less known was discovered by The arts journal whereby third-party funders sell portions of their collateral to anonymous partners, sharing the risk as well as any benefit.

Some of the biggest names in the game include the Nahmad family of art dealers, mega-dealer Larry Gagosian and billionaire collector José Mugrabi, all of whom are known to regularly offer third-party guarantees, or irrevocable offers, on works in exchange of a financial commission negotiated with the auction house. Although Gagosian and Mugrabi are unlikely to need a helping hand with their multi-million dollar collateral, the pair are believed to be swapping collateral with each other.

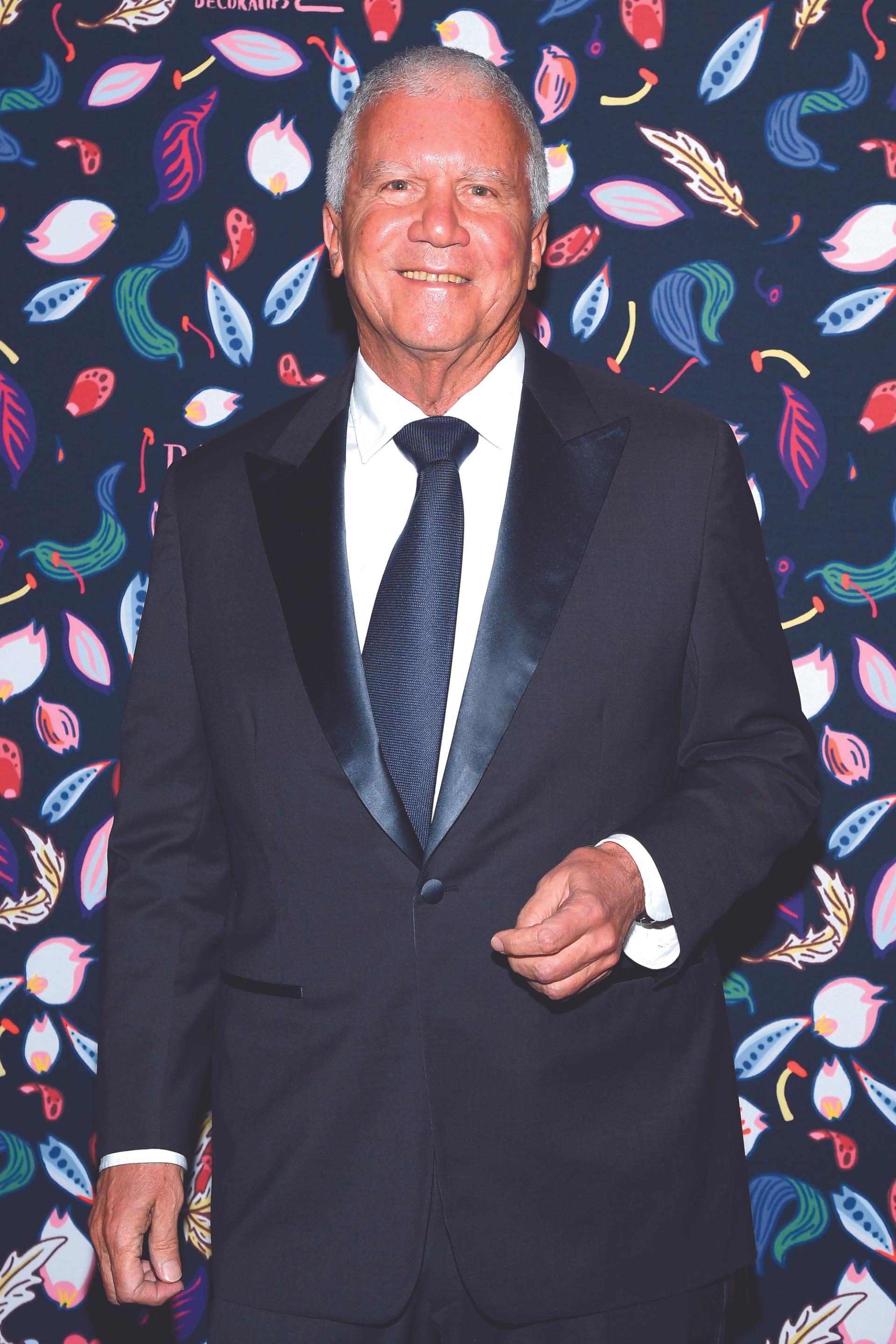

Left: Mega-dealer Larry Gagosian is said to be one of the biggest players in the third-party guarantee game

Photo: Pascal Le Segretain/Getty Images

So why is this collateral secondary market emerging now? As the international art market softens in the wake of global economic insecurity, the appeal of third-party guarantees to auction houses, which can ease the reluctance of wary senders, has become more and more attractive. It can also be a win-win for the guarantor, who either buys a work at an “insured” price if it doesn’t sell at auction, or gets a decent share of the profits if it sells above the guaranteed price.

However, while third-party guarantees ensure a minimum price regardless of the price of a work at live auction, they carry increasing risk. According to analyst firm ArtTactic, the estimated average yield on collateral fell from a high of 21.8% in 2021 to a seven-year low of 11.1% in 2022.

Commenting on the development of the secondary collateral market, a prominent New York lawyer active in art market trading explains: “Third-party guarantors began to cede some of their own risk to others; then, given the upside possibilities, a secondary market developed. People looked to make deals and guarantors sold some or all of their upside potential.

A New York-based private dealer who has orchestrated at least 20 or more of these transactions walked this writer through the steps of getting a third-party warranty and what happens next.

“I go through the viewing and research and then decide whether to guarantee it or not. I approach one of the specialists who in turn approaches the management for the possibility of a guarantee. When they come back to me – sometimes two days before the auction – and ask me if I’m still interested, that’s when I call people and ask them if they want to participate, what percentage, etc. It’s usually four, sometimes three, including myself, so I’ll own either 25% or 33% of the painting.

“Let’s say I guarantee it 20% below the low estimate set at $1.2M and I guarantee it at $800,000. If it sells for $1 million, I get $40,000. If it doesn’t sell, it’s mine.

When asked if the auction houses are aware that secondary transactions are being negotiated, the dealer replied: “They may know informally because they see us hanging out together, but legally and from the point of view paperwork, I’m the only one and they prefer it that way.”

Against auction house rules

This development and scenario goes against and apparently violates the rules of the auction house and the language found in third-party guarantor agreements. For example, in a year-old example of a Christie’s deal reviewed by The arts journal between the auction house and the third party guarantor, some of the fine print clearly states: “you will not share any monies paid to you under this agreement with any third party; and you have not entered into and will not enter into any agreement with a third party regarding your interest in the Property and your obligations under this Agreement.”

This language is pretty much boilerplate among auction houses, according to several knowledgeable observers. A Sotheby’s spokesperson said the auction house was unable to comment “on the terms of our financial agreements with clients”.

Asked about this clause, the anonymous guarantor replies – a little jokingly – “If you go letter by letter, no one will ever sign it.” He adds: “All I care about is the 20%, 25% or 30% or whatever amount we agree on.”

Ironically, this relatively recent phenomenon emerged and perhaps flourished just a year after New York City unilaterally eliminated auction regulations and, with it, all official oversight of the art industry. , including the obligation for auction houses to announce when they have a financial agreement. participation in a piece sold.

Yet, the evidence for these covered third-party warranty sales is not widely acknowledged or acknowledged. “I don’t have any examples,” said Jean-Paul Engelen, president of Phillips. “But it is entirely possible. How different is it from resellers who buy things together as partners? It’s hedge against hedge, so I wouldn’t be surprised if that happened.

New York art attorney Thomas Danziger of Danziger, Danziger & Muro says he’s “heard of people associating with these things in the past,” but adds, “I can’t tell you is new; it almost feels like a brokerage of an irrevocable offer. It’s as if the auction houses give a guarantee to a sender and then go offload the risk on a third party who is the irrevocable bidder.

Danziger says he hasn’t observed the sale of third-party warranties first-hand, “but has it happened? Of course”.

Whatever form they take, third-party warranties are obviously here to stay and have grown out of the perception a decade or more ago that a marking like this in the catalog was a knock on the picture.

As Engelen observes, “They are a big factor in today’s auction market, 100 percent.”