Nine years after the launch of the second generation of blockchain, the technology has found new life as a home for digital contracts. Artists and the art market have begun to see the promise that the blockchain – on which digital transactions are permanently recorded – can serve as a permanent record of the authenticity of a physical work, while setting the conditions for a secondary sale for the benefit of the creator of the work. beyond the primary sale.

This promise stems from blockchain-powered companies in other industries that also trade high-value items, including Everledger, founded in 2015, which secures authenticity and ethical sourcing records for diamonds by tracking their provenance. , including a “digital twin” of every piece of jewelry – from mine, to jewelry, to unalterable files held on a blockchain.

“Digital folders allow artists to add text, images, and PDFs to create rich provenance”

The art market, which experienced a first roller coaster engagement with blockchain as a home of non-fungible tokens (NFT) – digital tokens that have sold at eye-popping speculative levels in 2021 – have been offered a new engagement with technology over the past year, with the emergence of platforms dedicated to using blockchain to host a digitized version of the interaction established between artists, dealers and collectors, in the purchase and sale of new material works of art.

Indelible disc

The benefits offered are a permanent record of the authenticity and transparency of a transaction, for both buyers and sellers, and allowing artists to set contractual terms, held on the blockchain, for the secondary sale of their work. . (Physical art creators will seek to learn from the recent experience of those NFT artists who sold their digital art on one blockchain but then missed out on resale royalty terms when the buyer sold the piece on another. blockchain.)

Two of the main players in the field are Fairchain, a US-based start-up founded by artists and Stanford University graduates, which since 2021 offers certificates of authenticity stored in the blockchain and royalties to resale, and Arcual. The latter, a blockchain-powered platform backed by the LUMA Foundation, MCH Group (owners of Art Basel) and BCG X (the technology arm of Boston Consulting Group) bases its process on a dual-signature agreement, the Certificate of authenticity, between dealer and artist. These certificates “always include several signatures”, explain Arcual’s product director, Rodrigo Esmela, and its technical director, Michael Schuller. The arts journal. This means, they say, “the parties cannot unilaterally define terms or conditions, allowing galleries and artists to define the exact representation of the artwork on the blockchain and the terms and conditions of any sale. or resale”.

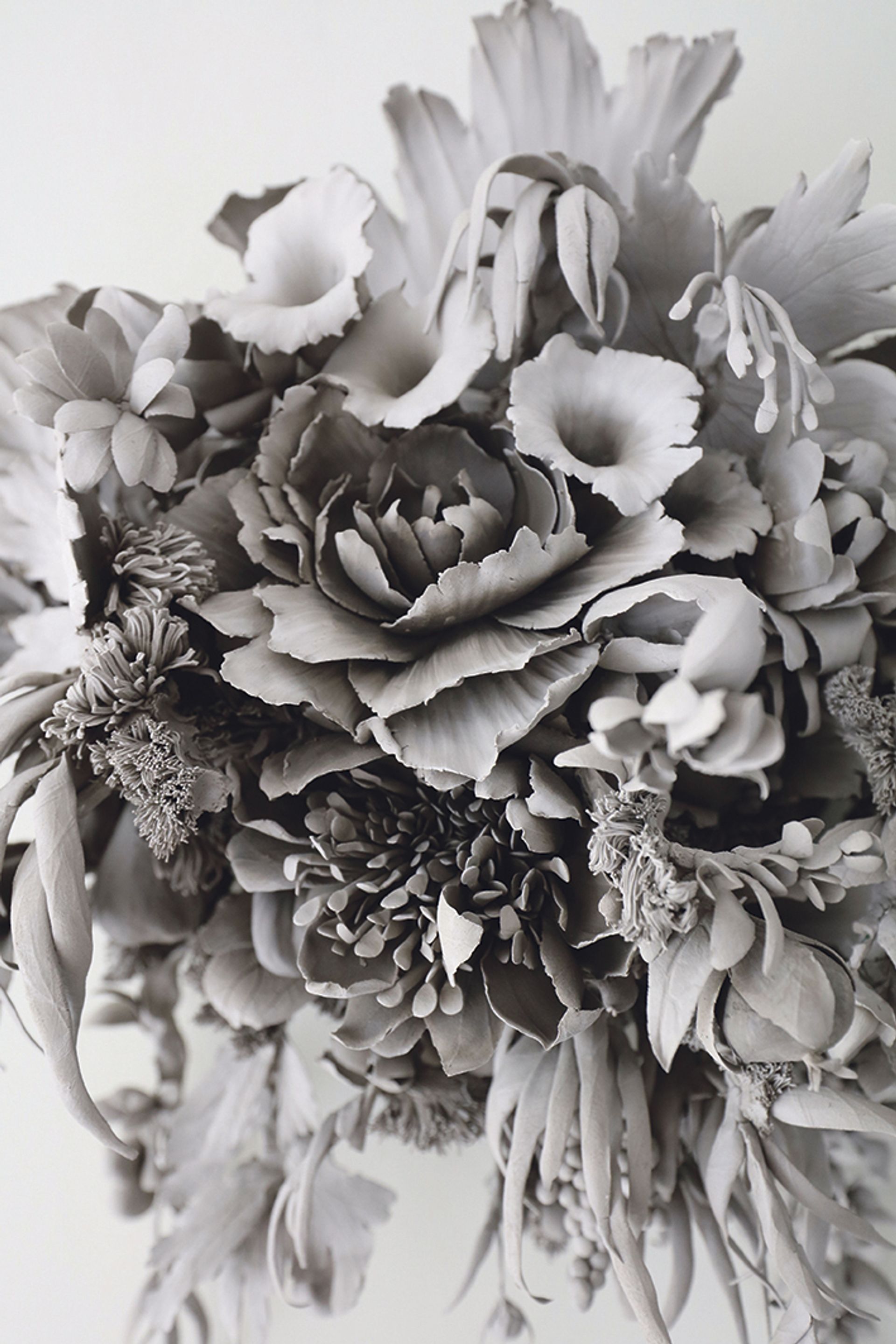

Phoebe Cummings’ works will be used by Arcual to present its digital files at Art Basel

© Sylvain Deleu

Seven months after its launch, Arcual has introduced “digital folders” – which it will demonstrate at Art Basel with the work of ceramic artist Phoebe Cummings – which allows artists to add text, images and PDF files to create a rich provenance, recording anything from the creation of the work to the artist’s intentions for its presentation. The information is as unalterable on the blockchain as its certificate of authenticity, and is part of a smart contract between artists, dealers and collectors. (Arcual can handle transactions of up to $1 million at a time and takes up to 1.5% commission on each sale.)

Bernadine Bröcker-Wieder, CEO of Arcual, worked closely with Everledger in her previous role as founding CEO of Vastari, the world’s largest database of private collections and temporary exhibitions, which has taken a investment in 2016 with Everledger. She says that, in conversations with artists, dealers and collectors, the word “blockchain” barely comes up; technology has almost become a given. And while blockchain-stored contracts designed for other industries — fashion, luxury, shipping containers — may depend on additional layers of technology to link contract and object, such as creating a digital twin or adding from an NFT chip to high-value fashion items, in Arcual’s digital folder, an artist can record unique personal authenticity marks. It can be a hard-to-detect symbol or a surface abrasion that is part of a piece’s unique physical makeup, added by the artist for an extra level of authenticity. The Arcual dossier is like a “manual for the work”, says Bröcker-Wieder.

Bernadine Bröcker-Wieder (above), managing director of blockchain-based platform Arcual

Photo by Jolly Thompson

Arcual’s digital records are necessarily private to the artist, dealer, and collector, but the potential form of these richly detailed provenances can be seen on platforms for other industries, including findmyinstrument.org, a website where the detailed history and physical characteristics of historical violins, violas and cellos are published, using x-rays, infrared images, endoscopes, photographs, videos and written descriptions. Of course, storing large volumes of detailed information raises questions about data laws, especially in relation to the GDPR which is prevalent in Europe and the UK. Asked about this by The arts journal, Esmela and Schuller said Arcual’s digital records and other information held on the blockchain are GDPR-compliant. “We only store the minimum information required. No personally identifiable information (PII) about buyers is stored in the digital folder, and only information relevant to the artwork is stored in the digital folder.

Artclear, another new blockchain platform for recording permanent provenance of art, offers a technical model closer to Everledger’s “digital twin” approach, providing microscopic-level digitization of works at using industry-standard technology licensed from hardware giant Hewlett-Packard (HP). The scan, and a digital code derived from it, is recorded on the blockchain as part of an Artclear fingerprint.

The ceramic works of Athene Galiciadis were entrusted by Arcual earlier this year

Courtesy of von Bartha Gallery Copenhagen

These new blockchain-based companies have caught the market’s attention. At Art Basel in Hong Kong in March 2023, eight galleries submitted works via Arcual’s Salesroom platform, including the Sabrina Amrani gallery with Carlos Aires and his sculpture Bon Appetit IV (2022), an assemblage of glazed porcelain plates, and Commonwealth and Council Gallery with Kenneth Tam for his video Silent Spikes (2021). For Stefan von Bartha, the owner of the Von Bartha Gallery, who used Arcual to document an exhibition in Copenhagen of painted clay vases by Athene Galiciadis, measure the worldearlier this year, the use of the platform is part of the fight “for a more transparent and fairer art world”.

As with all sorts of new technology platforms over the past 15 years, whether in the art market, publishing or gaming industries, potential customers from Fairchain, Arcual and other entrants on the field, are to varying degrees excited about the technology and wary of how it will achieve critical mass. London gallerist Oliver Miro, founder of Vortic, a virtual reality and augmented reality platform for the art world, recognizes the technology’s potential but wonders if this approach will work “unless the whole world of art doesn’t go to a model and a blockchain, and apply it”. strictly”.