After months of worrying about the inevitable correction in the face of rising interest rates, financial market volatility, the war in Ukraine and other destabilizing factors, the art market has finally caught up with reality. It happened during the first sale of Gerald Fineberg’s art collection at Christie’s on May 17 in New York.

Billed as “A Century of Art” and anchored by the works of the giants of modern, post-war and contemporary art, including Picasso, de Kooning and Pollock, the event proved to be the kind of test decisive that the art market has been eagerly awaiting.

At times, the crowded Rockefeller Center saleroom felt like a rummage sale. Batch after batch failed to reach their low pre-sale estimates. A shocking number of hammered works for a fraction of their projected values. Some, including what would once have been a coveted painting by superstar artist Mark Grotjahn, failed to sell all together.

“You are on the threshold of a period of serious correction,” said artistic adviser Todd Levin. “There’s no two ways about it.”

Sold by the estate of the Boston real estate developer who died last year, the 65-lot cluster was as pure — or bare, in the parlance of the art market — as it comes. There were no guarantees, irrevocable bids, or even lots withdrawn.

Estimated between $163 million and $235 million, the bid totaled $153 million, below its presale target range even after Christie’s fees were added to the hammer result of $124.7 million. At the same time, only six lots were not sold.

“Is there an impact of the macro environment on the art market? Yes,” Christie’s CEO Guillaume Cerutti said after the sale. “It’s confirmation. We’ve adjusted the reserves to make this work. Is the art market still alive? Yes. This market sent the signal that it was still working.

The strong sell rate of 91% was a function of declining reserves, according to Levin.

“If they hadn’t mitigated all those reservations, the sell-through rate of this auction would have been miserable,” he said.

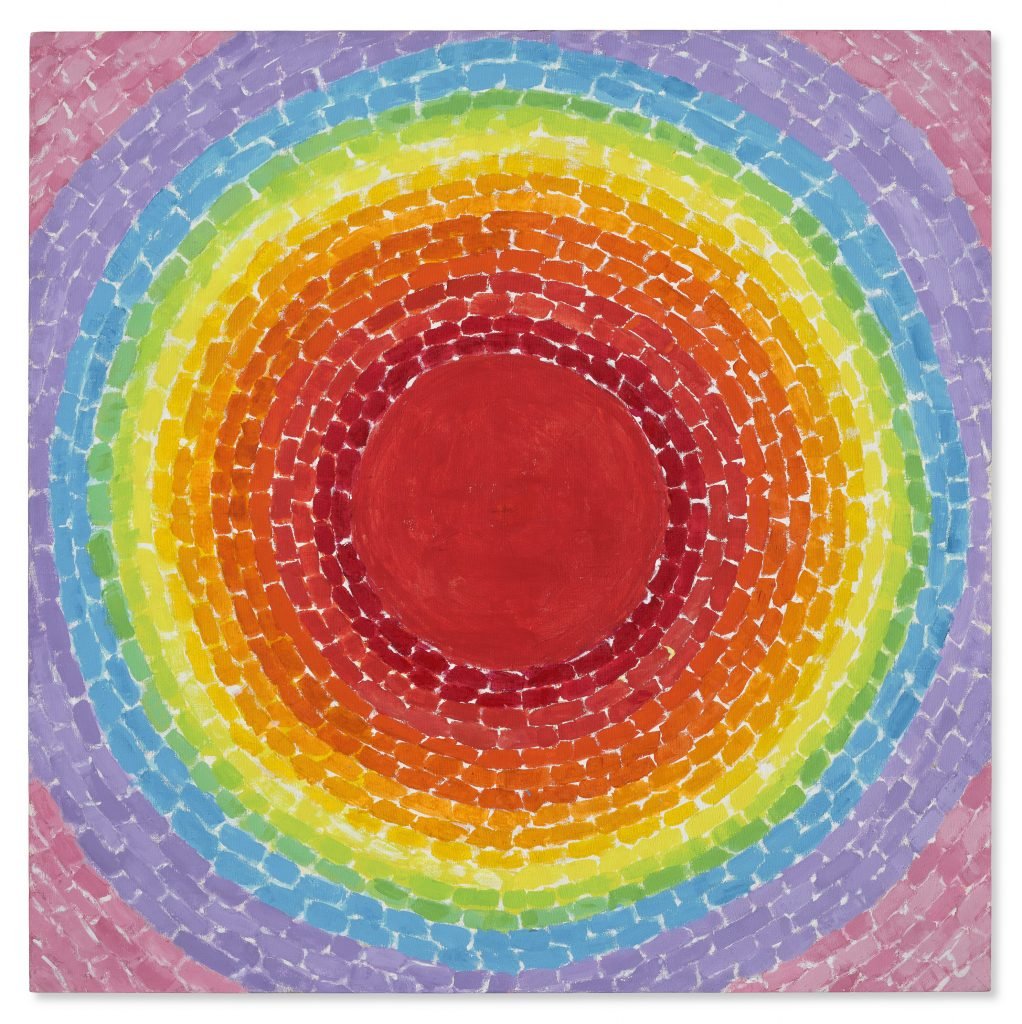

Alma Thomas, A fantastic sunset (1970). Courtesy of Christie’s.

“Buyers these days need a compelling reason to part with their money,” added Skarlet Smatana, director of the George Economou collection in Athens, Greece. “We are in a new era where money is expensive.”

Still, auction records were set for five artists: Alma Thomas ($3.9 million), Barkley Hendricks ($6.1 million), Jo Baer ($327,600), Alina Szapocznikow ($907,200 ) and Milton Resnick ($252,000).

(Final prices include fees; estimates do not.)

Thomas’ painting A fantastic sunset (1970) hammered in at $3.2 million. Fineberg bought the work for $2.65 million at Christie’s in 2019 when it was also a record high for the black painter. This time around, the work was estimated between $2 million and $3 million and attracted three bidders, including Levin who won it on behalf of a client.

“I’ve seen a lot of Thomas work come and go over the year,” Levin said. “In my opinion, this was truly one of the best paintings I’ve seen of her available.”

The sale included two paintings by Alice Neel, which Fineberg began collecting a year after the artist’s death in 1984. Neel’s portrait of two young girls in white blouses and red sweaters, The De Vegh twins (1975), grossed $2.6 million, topping the estimated $1.2 million at $1.8 million. The second Neel, Pregnant Bette Homitzky (1968), grossed $1.9 million, against a pre-sale estimate of $1.5–2 million.

Alice Neel, The De Vegh twins (1975). Courtesy of Christie’s.

Another highlight was a 1985 assemblage by Jean-Michel Basquiat. Title Brain, it consists of 27 wooden blocks, a collage of Xerox paper and paint. Fineberg bought the sculpture from art dealer Diego Cortez in 1990. Estimated at between $3 million and $5 million, the work attracted three bidders, including art dealer Jeffrey Deitch, who doggedly pursued it, to starting at $1.9 million, but ultimately lost out to Emily Kaplan, Christie’s. responsible for the evening sale. The final price of $5.6 million exceeded the high estimate.

But such results were the exception. Top lot of the night, Christopher Wool’s 1993 untitled colorful painting spelling “Fuck them if they can’t take the joke,” hammered in at $8.4 million (or $10 million with fees) by compared to the estimated range of $15-20 million.

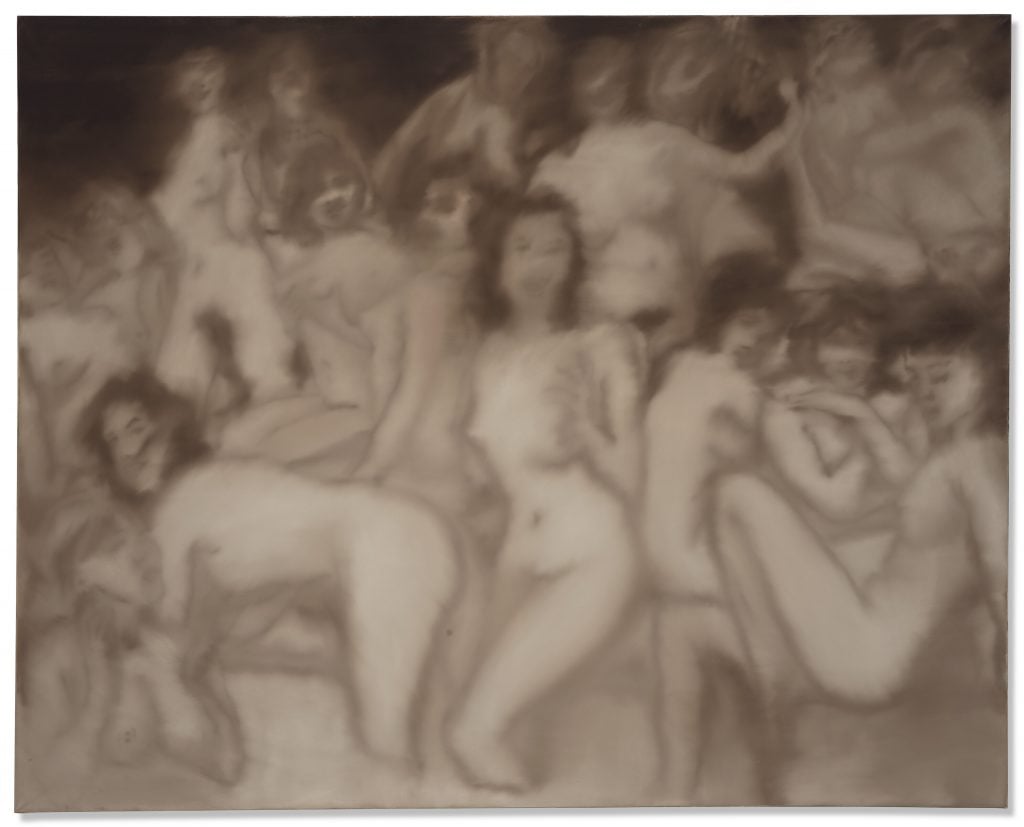

Gerhard Richter’s large photo-painting of blurry nude bathers, Badende (1967), was also estimated at $15–20 million. But he only attracted one bidder, hammering in $8 million (or $9.6 million with fees).

Gerard Richter, Badende (1967). Courtesy of Christie’s.

A late painting by Pablo Picasso Bust of a laureate man (1969) hammered in $7 million (or $8.5 million with fees), against an estimate of $9–12 million. Fineberg bought it for $7.8 million at Sotheby’s in Hong Kong in 2018.

Fineberg was an avid collector, according to Sara Friedlander, head of postwar and contemporary art at Christie. “Just when you thought he was on a path, he pivoted to an entirely different gender, gender, time period, place in the world,” she said. “He was eclectic and loving. Like all great collectors in love, this passion has led him in different directions.

The sale, for example, featured 16 lots from female artists, including Lee Krasner, Joan Mitchell and Helen Frankenthaler, long overlooked compared to their male AbEx counterparts.

Lee Krasner, Crossing the Twelve Hours, March 21 (circa 1971-1981). Courtesy of Christie’s.

But in tonight’s auction, collectors were unwilling to reach. An untitled Krasner painting fetched $3.5 million, below its low estimate of $6 million. The second, Crossing the Twelve Hours, March 21 (circa 1971-1981), hammered in at $2.8 million, short of its low estimate of $4 million.

Alex Rotter, Christie’s president of postwar and contemporary art for the Americas, said the disconnect between estimates and prices was a result of timing. The estimates were made months earlier, in a different economic environment, shortly after Paul Allen’s auction triumph.

“We are finding a price level,” Rotter said of the impact of selling Fineberg. “It gives you a blueprint for where we are.”

Follow Artnet News on Facebook:

Want to stay one step ahead of the art world? Subscribe to our newsletter to receive breaking news, revealing interviews and incisive reviews that move the conversation forward.