New York auction houses predict their spring marquee sales could fetch more than $2.2 billion, despite fears the art market could cool, both for contemporary works judged risky by collectors in times of economic uncertainty and for the more expensive works that shippers may hold back given the uncertain macroeconomic situation. This month, jobs with nine-figure estimates, or even estimates in the top eight, are particularly absent. There’s no Georges Seurat masterpiece or Andy Warhol portrait of marilyn Or Disaster cloth to test the appetite of deep-pocketed trophy hunters, like in recent seasons.

Dealers say that factors such as war, failing banksan uncertain political outlook and rising interest rates are not stopping wealthy collectors from buying art, but recognize that the turbulent economy may prevent them from repeating record high bids from the last rounds of major auctions .

“I wouldn’t say this market is suffering anything. I think it’s still very solid and very stable,” says Emily Kaplan, co-manager of the 20th Century Evening Sale at Christie’s. “The completely unprecedented auction results we’ve seen over the past two years may have tempered it slightly.”

Christie’s New York is devoting several sales this month to the collections of a single owner. They include works from the collections of the Chicago commodity trader Alan Press and his wife Dorothythe late administrator of the Boston Institute of Contemporary Art Gerald FinebergAnd Sophie Danforth, whose family founded the Rhode Island School of Design. Also heading to the auction block are pieces from the publishing billionaire’s collections SI Newhouse and co-founder of Microsoft Paul Allen. Christie’s estimates its May sales will bring in between $760 million and $1.1 billion.

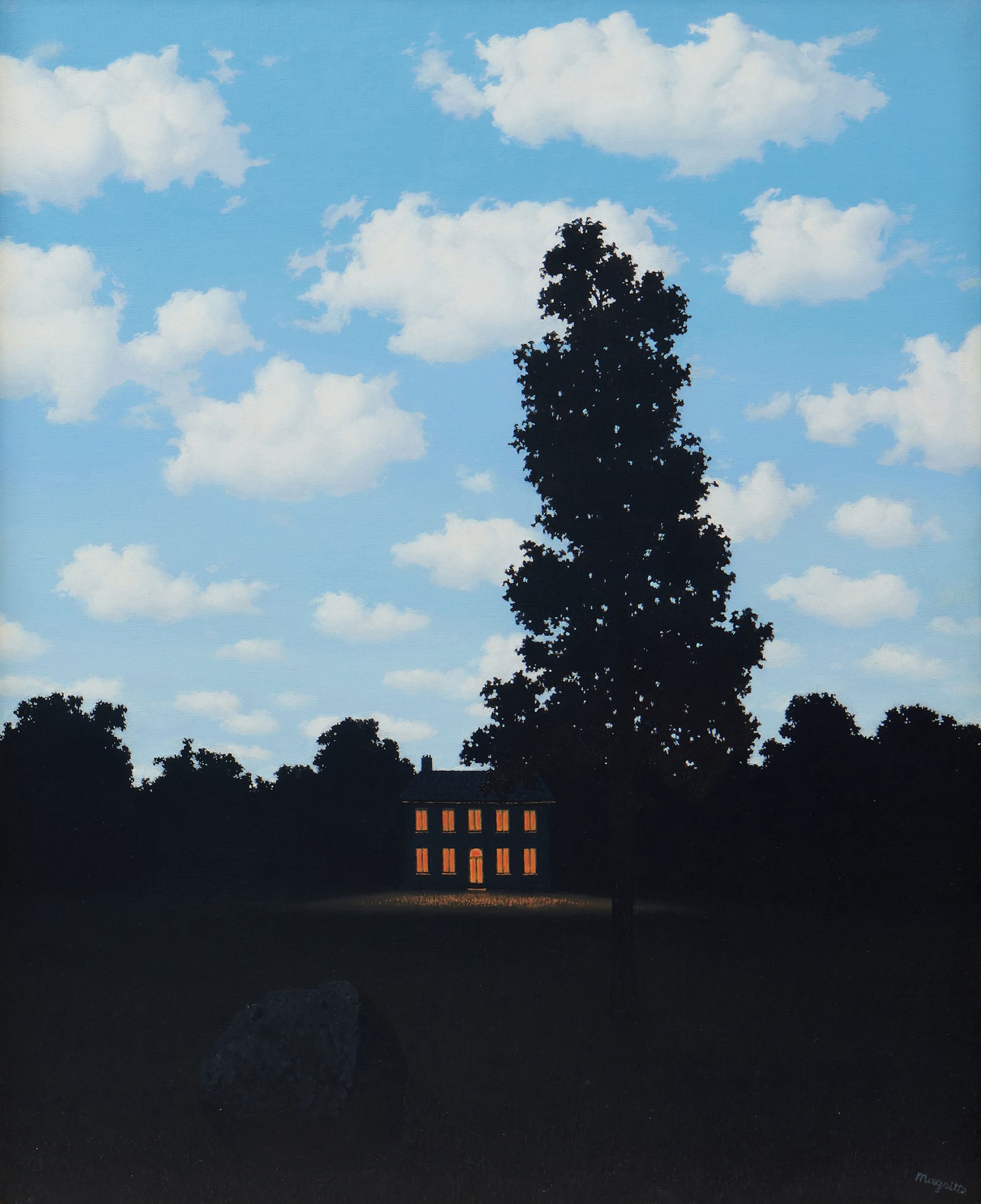

René Magritte, The Empire of Lights1951 Courtesy of Sotheby’s

“Weaving a narrative about the collections helps show collectors how special these works are,” says Kaplan. “That’s why we love selling collections, so we can tell those exciting stories that our customers respond to so well.” Last year, Christie’s grossed $1.6 billion of two sales from Allen’s collection.

During the 20th Century evening sale at Christie’s on May 11, Burning gas station (1966-69) by Ed Ruscha from the Press collection is estimated between 20 and 30 million dollars. This is only Ruscha’s second painting Stations series to appear at auction, according to Christie’s.

“For me, it’s the work that represents the whole of the last industrial revolution and the whole of the 20th century,” says art consultant Lisa Schiff, who founded New York-based company SFA Art Advisory. “I hope someone really spectacular gets it, and I hope it goes high.”

Christie’s is also focused on showcasing female artists and promoting their markets, Kaplan said. Half of the lots in its 21st Century auction on May 15 are by women.

Kaplan adds, “The market is generally quite aware that works by female artists and artists of color have been undervalued. Many collectors see this as a smart investment…and want to focus on a wider variety of artists and ensure their collection is more representative.

Monumental basquiats

Christie’s 21st Century Evening Sale is led by Jean-Michel Basquiat El Gran Espectaculo (The Nile) (1983), a massive canvas that is expected to fetch around $45 million. This is not the only monumental work by Basquiat on sale this season. Three nights later, Sotheby’s New York offers It is time (1985), Basquiat’s rendition of jazz legend Charlie Parker’s 1945 disc of the same name. Sotheby’s estimates the painting will sell for around $30 million when it debuts at auction, having spent decades in the collection of magazine publisher Peter Brant, the only person to own the painting. It’s one of the most valuable works on offer this month from Sotheby’s, which predicts its May sales will reach between $732.3 million and $1 billion.

Louise Bourgois, Spider1996 Photo by Edouard Fraipont, courtesy Sotheby’s

During the same evening of contemporary art, Sotheby’s offers a large three-meter Spider (1996) by Louise Bourgeois which will probably be break at least one auction record. Its estimate between 30 and 40 million dollars is the highest ever for a bourgeois work, according to Sotheby’s. If it sells for the low end of the estimate, it will likely become the most valuable bourgeois work to sell at auction, fetching $28 million ($32.1 million with fees) another version of Spider (1996) retrieved from Christie’s in May 2019. If the sculpture’s price rises above its estimate, it will rival the record for any work by a woman at auction, currently held by Georgia O’Keeffe’s. Jimson weeds (1936), which Walmart heiress Alice Walton bought for $44.4 million (with fees) in 2014.

Insel im Attersee (1901-02), a rare lake landscape by Gustav Klimt, is expected to fetch around $45 million at Sotheby’s during the auction house’s modern art evening on May 16. Another highlight of the sale is that of Peter Paul Rubens Portrait of a man as the god Mars (circa 1620), estimated between $20 and $30 million. The painting comes from a set of works taken in a complicated divorce between former Metropolitan Museum of Art trustee Mark Fisch and former judge Rachel Davidson. Ten other Baroque paintings in their collection, including another Rubens, fetched $49.5 million with fees at Sotheby’s earlier this year.

Gustave Klimt, Insel im Attersee1901-02 Courtesy of Sotheby’s

A dedicated evening auction and a sequence at a contemporary art day have been reserved by Sotheby’s for the collection of the late Warner Bros. music director. Mo Ostinwhose works by René Magritte, Cy Twombly, Willem de Kooning, Basquiat, Joan Mitchell, Cecily Brown, Takashi Murakami and Pablo Picasso are estimated at over $120 million.

At Phillips, the auction house’s only evening sale will be led by Banksy’s Banksquiat. Boy and dog stopping and searching (2018), a painting that the pseudonymous British artist produced in response to a 2017 Basquiat exhibition in London. On a wall near the Barbican Centre, where the show was held, Banksy spray painted a figure inspired by Basquiat’s painting Boy and dog in a Johnnypump (1982) searched by two London policemen. This version on canvas, published by Banksy the following year, is estimated between 8 and 12 million dollars. The painting is the most valuable work on offer this month at Phillips, which expects to fetch between $92.5 million and $133 million over one evening and two days of sales.

During the same evening sale as the Banksy, two first sculptures by Yayoi Kusama, red stripes (1965) and blue spots (1965), are estimated between $2.5 and $3.5 million each. Kusama is one of the world’s most beloved living artists – and is the subject of an ongoing collaboration with Louis Vuitton, the world’s biggest luxury brand – but her early works are still “extremely rare” at auction, said Robert Manley, vice president of Phillips. and its Global Co-Head of 20th Century and Contemporary Art. It’s extraordinary that the auction house is offering two at a time, he adds, pointing out that Kusama was proud enough of both works to be photographed several times standing in front of the sculptures.

“His market could not be stronger”

“It’s just one of those wonderful times when art history and the art market align, because its market couldn’t be stronger,” Manley says. Last year Phillips set Kusama’s auction record when his painting Untitled (Nets) (1959) sold for $10.5 million including fees.

While auction houses are optimistic about sales this month, some collectors are being more cautious when it comes to buying art, dealers say. The last Art Basel and UBS art market report, published last month, find auctions fell 2% last year to $30.6 billion (including public and private sales), largely due to low turnouts in China after Covid-19 shutdowns blocked fall sales. The high end of the auction market was the most resilient, with works priced above $10 million rising in value by 12% – the only part of the business to increase last year, according to the report.

In times of economic uncertainty, wealthy collectors tend to focus on buying works by more established artists who they believe pose less investment risk than fashionable contemporary artists whose works have inspired speculative frenzies in recent years. While auction houses and dealers say they have observed a sense of sluggishness among collectors amid uncertain market factors, they do not anticipate this to disrupt May auctions.

“People were quick to announce the impact of a recession and the idea of the art market failing,” says Lucius Elliott, who runs Sotheby’s The Now art sale. created over the previous two decades. “Based on the interest we have from third-party guarantors and preliminary interest already, this does not look like a bear market.” Even so, he adds, there has been a “slowdown” in some areas of the market.

Compared to previous years, Manley says, buyers “are a bit more selective.” As a result, the market may be “a little less frothy”.