This week’s auctions in London will be scrutinized. First, to see if the British capital can maintain its status as the world’s second-largest art market despite the bleak and gloomy prognoses piling up on its doorstep, and second, to gauge how well sellers might need to readjust their views.

The British capital’s summer season has traditionally been a high point for the art market which nestles perfectly with top social and sporting events like Wimbledon and Ascot. But, under the weight of Covid, Brexit bureaucracy, war, inflation and general economic pessimism, London is struggling.

Consider that in 2015 Impressionist, Modern and Contemporary art auctions at Christie’s, Phillips and Sotheby’s fetched over £600 million and were accompanied by bustling, luxurious art and antiques fairs such as Masterpiece and co-operative gallery events such as London Art. Week. Cut to now, and Masterpiece was unceremoniously abandoned by owner-operator MCH earlier this year (although a new event, The Treasure House Fair, has resurrected in his place and is doing well enough to keep the London flame alive) and although London Art Week will go on as normal, as will the auctions, these seem to have slipped in terms of weight.

To date, pre-sale estimates for the impressionist, modern and contemporary art on offer range between £267m ($339.7m) and £360m ($458m), excluding premium the buyer, according to ArtTactic. That’s a far cry from 2015, and slightly less than the £421m total made last year, including the buyer’s premium.

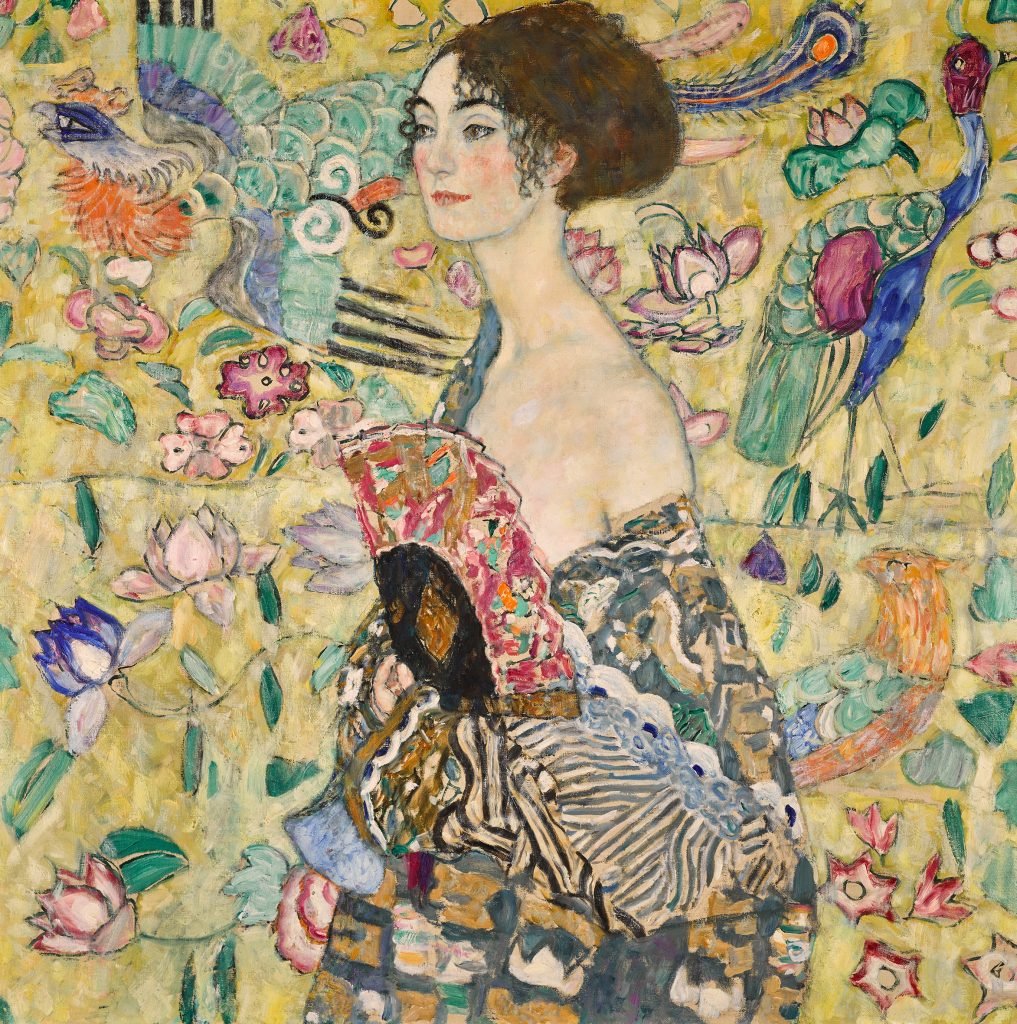

With fewer great Monets or Picassos on the block than usual, the composition of the series relies exceptionally on a single work, that of Gustav Klimt. Dame mit Facher (Lady with a fan) (1917-18), estimated by Sotheby’s at £65 million ($82.7 million) and guaranteed, making it the most expensive painting ever sold at auction in Europe. It was last sold in New York in 1994 when it grossed $11.7 million. The buyer was as anonymous then as he is now as a seller, that is, “deeply anonymous,” according to market experts and scholars familiar with the work.

Gustav Klimt Dame mit Fächer (Lady with a fan) (1917-18). Estimate in the region of £65m/$80m. Courtesy of Sotheby’s.

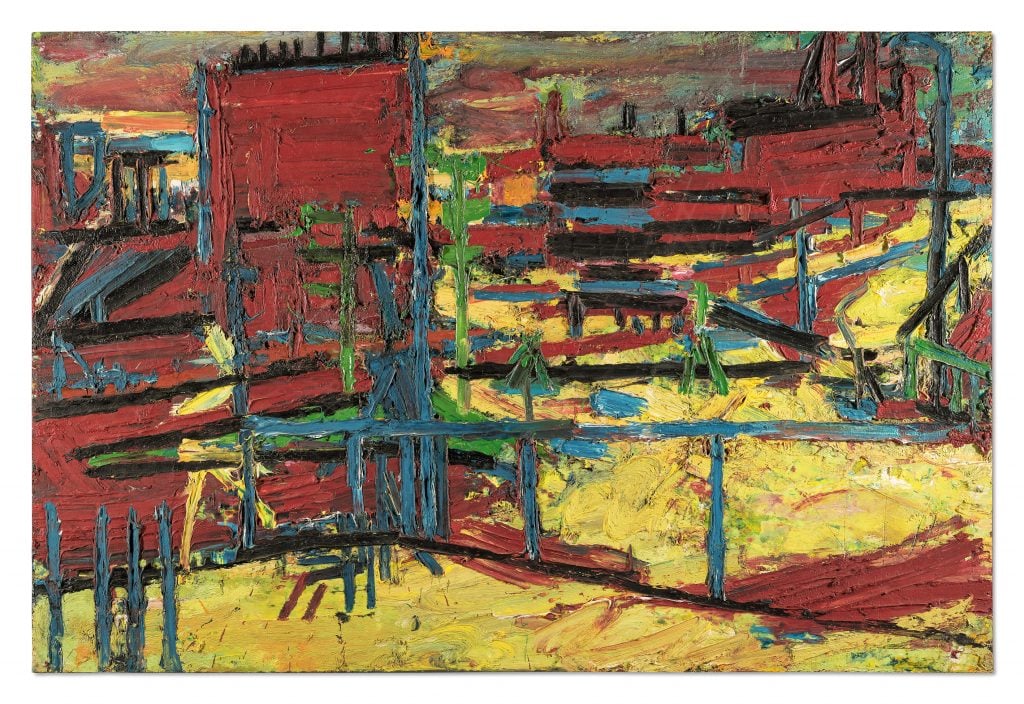

Not quite so anonymous, if anonymity is a matter of degree, is someone whose collection is under the moniker “Britain’s Visionaries” at Sotheby’s. The collection includes prominent works by Lucian Freud and Frank Auerbach worth £13–18.5 million ($16.5–23.5 million). Freud’s late 1960s portrait of Penny Cuthbertson, a devastated-looking society beauty in a studio chair, was acquired from Charles Saatchi in the 1990s and carries the highest estimate ever. sending £8-12 million. A great Auerbach, Mornington Crescent (1969) carries the highest estimate to date for a work by the artist between £3.5 and £4.5 million, is guaranteed by a third party and could rival the auction record of 5, £6m ($6.3m) set last October (though another Mornington Crescent painting is said to have sold privately for more through the Piano Nobile Gallery).

Frank Auerbach Mornington Crescent (1969). Estimate: £3.5-4.5 million. Courtesy of Sotheby’s.

The sender of the “British Visionaries” was advised in the 1980s and 1990s by private dealer Ivor Braka, who understandably remains silent about his identity. However, Artnet has learned that the seller is investor Douglas Woolf, who has a huge real estate portfolio in London as well as shopping malls and residential properties in Boston, Texas, Massachusetts, North Carolina and Alabama. Now in his eighties, Woolf and his family business are esteemed by the Sunday time having paid £11.6million in tax last year. Maybe they’ll owe a little more next year when those sales are done.

Another seller Artnet can reveal is Michael Green, the founder of now-defunct media conglomerate Carlton Communications and former chairman of broadcast company ITV, now 70 and a practicing psychotherapist. In 1987, he engaged in a bidding war with his wife, Wolfson heiress Janet Green, to buy the Howard Hodgkin film. Spectator (1984–87), at the Whitechapel Art Gallery fundraising auction, presided over by a young Nicholas Serota. They spent a generous £172,000 including premium against a pre-sale estimate of £35,000-£50,000. Green is now selling it at Christie’s with an estimate of £800,000-1.2 million, the highest to date for a work by Hodgkin. After their divorce in 1989, Janet married financier and collector Gilbert de Botton (who spearheaded the trend to buy late Picassos in the 1980s) and became a trustee of the Tate. In 1996 she presented 60 works of art at the Tate, including pieces by Carl Andre, Richard Artschwager, Gilbert & George, Richard Long, Cindy Sherman, Roni Orn, Gary Hume, Nancy Spero, Andy Warhol and Bill Woodrow.

Howard Hodgkins The spectator (1984-1987). Estimate: £800,000-£1,200,000.

The Whitechapel sale was one of the first auctions I covered as a journalist and I remember well how Serota, who learned that I was presenting a preview of the sale for the London Evening Standard, called me to say that if I published expected prices he might not get the local government grant that was being considered that week because the council would think he could just sell some art whenever the gallery needs money. It was not feasible, he said, because some artists like Hodgkin, who had donated some of his best work, would not repeat the gesture. The Whitechapel sale was unique with other very generous donations from Anselm Kiefer, Robert Ryman, Brice Marden and Gerhard Richter. So, I delayed the item, and after the Whitechapel received their grant, the auction did way more than the estimates had suggested with no negative feedback. Serota, with his proven skills in managing money and the press and reading the contemporary art market, went on to run the Tate soon after.

Another shipper that Artnet can reveal is Berlin-based collector and Wella hair care estate heir Thomas Olbricht, who owns several works at Phillips by George Condo, Jake & Dinos Chapman, and Wim Delvoye. Now 75, Olbricht has been making disposals of his extraordinary contemporary art collection in his Me Collectors Room since it closed in 2020, and these are the last. condo painting Jesus (2007) (£500,000-£700,000) has been exhibited in several museum exhibitions but only once, at the Kunsthalle Krens in 2010, under his name. The same goes for the painted bronze of Jake & Dinos ChapmanSex 1 (2003) (£60,000-£80,000), another of which was shown at their Turner Prize exhibition in 2003, and Delvoye’s The Chapel (2007) a stainless steel cathedral over 10ft high, interior lit by stained glass, and another work in this series to achieve one of the highest estimates to date (£100,000-£150,000 ) for the artist.

George Condo Jesus (2007). Estimate £500,000-£700,000. Courtesy of Philips.

Other sales agents include the late real estate investor Gerald Fineberg at Christie’s, whose $153 million sale in New York in May was seen as a turning point between the seller’s market and the buyer’s market, as many works sold well below pre-sale estimates. The 11 works (estimated at £5-6 million) at the Fineberg estate in London are led by Twombly oil and wax pencil from 1956 with an estimate of £2-3 million.

Also testing current optimism for Auerbach’s market is Magnus Konow, son of the Norwegian sailor who befriended Francis Bacon and became a regular drinking buddy of the entertainer in Monaco in the 1970s. Konow’s mother, Olga, bought Auerbach’s heavily encrusted one EOW on his blue comforter V11 (1963) in 1978, leaving it to his son on his death in 2002. The estimate is £2.5 million – £3.5 million for the small but much admired 16×20 inch painting.

Buried in the bottom of Christie’s Impressionist and Modern sales are a dozen works on paper from the Deutsche Bank collection, some assiduously assembled by curator Alistair Hicks during his 20-year tenure, which is the final installment of the bank’s sales, which is now focused on newer contemporary art.

But estimated at £200,000 in total, they in no way distract from the fact that apart from Klimt there are only two other works at Sotheby’s estimated to be in the seven figures (Douglas Woolf’s Freud and a Twombly), and none at this level at Christie’s or Phillips.

Noticeable buying activity at the Treasure House Fair and the influx of advisers to auction previews last week gave the impression that London was still very much alive. But how much was it really a search for bargains in a buyer’s market? The answer will come this week.

Follow Artnet News on Facebook: