You are waiting for an Uber. Maybe you’re leaving for a dinner in Basel or a party in Miami Beach.

The application is running … it “watches”.

Finally: “12 minutes”.

“12 minutes”?

Like China’s social credit system, Uber considers large amounts of data when matching a passenger with a driver. The algorithm isn’t public, but knowing everything Uber knows about us, it’s not unlikely that there is both a public and private score that impacts the passenger experience.

What if the art world worked the same way? Are you sure that’s not the case?

While the art world is a world of big money – $65.1 billion according to Art Basel and UBS’s 2022 Global Art Market Report – at its heart is reputation economy. There are blacklists in the service of protecting artists and blacklists in the service of petty disputes. There is imperfect and skewed information about galleries, collectors and artists not following up on payments. There are “open secrets”. Rumors abound. Technology is changing both the way the art world considers and is held accountable. Here are three trends and technologies to watch.

1) Phantom collectors and glass doors

Ghosting, which has been made popular by dating apps, describes the practice of ending all communication and contact with another person without any apparent warning or justification and ignoring any further attempts at communication. According to harvard business review, ghosting in professional settings is also on the rise in other industries. Inert behavior may seem more or less safe in a world where data is not centralized, but galleries, institutions and even artists now use database software like Art Logic and the less art-centric HubSpot which keeps track of customer information, artwork databases, digital marketing return on investment (ROI), and sales processes.

What Uber lacks in the art world is a virtual monopoly creating fully owned centralized data collection. As the art world becomes more technical, we can expect better systems to be in place with the potential to understand trends. What should an artist or employee do when not being paid by a gallery? Glassdoor is a website where current and former employees anonymously review companies. Many major galleries participate, with ratings and reviews from management that paint a less than friendly portrait that is unlikely to deter collectors, but might convince entry-level employees that the fee isn’t worth it.

2) Crypto

Cryptocurrency is used to pay for physical artwork as well as NFTs. In a previous article, I mentioned how the UAE’s tax-free capital gains have helped make it the home of many crypto collectors. Over a year ago, Dubai-based gallery Galloire became the first gallery in the region to be able to legally accept crypto as payment. According to founder Edward Gallagher, “Part of the heart of Galloire as a gallery and art platform is to break down the barriers between the digital and the physical: in the sense of art mediums yes, but in any way, including how we can see art and exhibitions, but also how we can pay for art. At first I was skeptical about its adoption. Crypto transactions expose galleries and artists to huge fluctuations in prices. exchanges. But it turns out that 20% of purchases at the gallery are in crypto instead of fiat currency. The gallery understands the risks but sees this as an important part of welcoming new collectors. “We want the public art collectors is growing and so we want people to acquire art the way they want to,” says Gallagher. Other technologies that limit the operational drama involved in paying and getting paid are Stripe, Square and the exchange-friendly Revolut bank.

3) Arcual

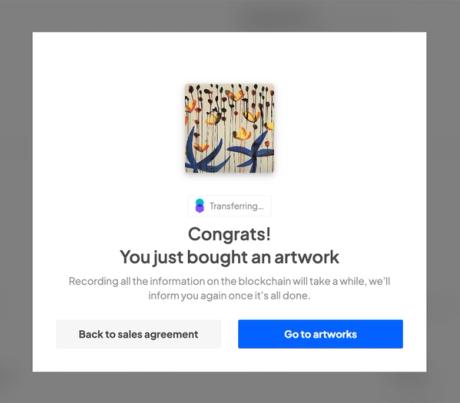

When there is structure and reliable technology and systems in some parts of the art world, it allows for more freedom, creativity and humanity in others. An interesting emerging solution is Arcual, a system that supports royalty sharing, efficient payments and digital records of authenticity. Launched at Art Basel in Miami Beach last year, it has serious art-world backers with the LUMA Foundation and MCH Group, Art Basel’s parent company. The software uses blockchain technology, but not cryptography, to remove the drama and transaction time from collecting and dispersing payments. At the moment, galleries are invited by the platform and initiate consignment agreements for works that must be approved by the artist. The agreement is recorded on Arcual’s authorized blockchain which emphasizes data confidentiality, and this information remains private between the gallery and the artist. When the gallery sells a work, the collector validates a sales agreement allowing him to proceed to payment by debit, credit card or bank transfer in the agreed currency. Once the collector has successfully paid the contract of sale, the new owner of the work is registered in the official and immutable register. The gallery and the artist are paid simultaneously according to the terms they both had when the consignment contract was created. The platform suggests other future possibilities, ranging from standardized resale royalties to more complex breakdowns of revenue from art sales.