The so-called ‘great wealth transfer’ of the baby boomer generation is increasingly visible in the art market, but will there always be demand to match their taste? -war ?

According to the latest tally from research firm Cerulli Associates, Americans can expect to inherit $73 trillion over the next 25 years, with 42% of transfers expected to come from the top 1.5% of households. These own the most stocks, property, and – we can safely assume – art. Individual collections have driven the art market in recent years, with most coming from recently deceased owners. Last month’s gigantic New York sales included 16 works from the collection of media heir SI Newhouse, estimated at more than $144 million; 220 works worth over $270 million, by collector Gerald Fineberg; $40 million from Microsoft co-founder Paul Allen, who boosted last year’s auction results by $1.6 billion, and 33 works estimated at $120 million from record producer Mo Ostin .

Just like an aging manifold, the air gets thinner on top

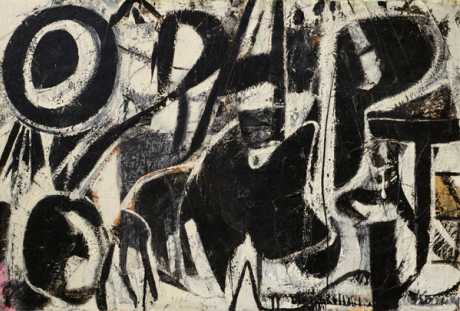

Many of the highlights are courtesy of 20th-century greats we’ve seen a lot of lately: think Willem de Kooning, Picasso, Gerhard Richter and René Magritte. So far, so good. We have learned that art is a supply market that seems to defy economic logic. In the multi-million area, collectors will continue to purchase these “significant” works at full appraisals, regardless of context.

But, just like an aging manifold, the air gets thinner on top. One of the concerns, which consulting firm Cadell points out to its clients, is that just as the baby boomer generation is dying out, so too is its taste. A recent report from Sotheby’s and ArtTactic reveals baby boomers (born between 1946 and 1964) made up 40% of bids on over $1 million worth of art in 2022, up from 48% in 2018. Cadell says that while this trend continues, numbers halving over next 10 years.

Change of taste

Young collectors are a growing proportion in the over $1 million area, and their heirlooms will continue to pour in, but the question is, what will they want to buy? One of the reasons for selling art in the first place is that the children and grandchildren of collectors think differently than previous generations. One example that emerges from the latest report from Art Basel and UBS is that dealers’ share of video art sales, a long stubbornly slow market, increased significantly last year, from 1% to 5%. . The market is unlikely to shed its love for painting anytime soon, but a change of course is plausible as the definition of art continues to expand. Not so long ago, the old masters were at the top of the taste tree.

A change is already underway – the art of dead white men seems less and less relevant and undesirable. Auction houses are scrambling to show the diversity of their collections on the block this month, including Fineberg’s, but it’s an uphill battle given the pool of work available. At some point, there won’t be enough 20th century women or artists of color to bridge the gap. In the meantime, expect more and more boomer collections to hit the market, before the air gets even scarcer.